All Categories

Featured

Table of Contents

According to SEC officials, existing CDAs have actually been registered as safeties with SEC, and therefore are covered by both government securities regulations and policies, and state insurance policy laws. At the state level, NAIC has actually established state disclosure and viability laws for annuity products. Nonetheless, states vary on the degree to which they have actually adopted these annuity policies, and some do not have securities in any way.

NAIC and state regulatory authorities informed GAO that they are currently assessing the policies of CDAs (annuities investments). In March 2012, NAIC began reviewing existing annuity regulations to identify whether any kind of adjustments are needed to attend to the distinct item layout features of CDAs, consisting of possible alterations to annuity disclosure and viability standards. It is likewise examining what sort of capital and scheduling needs may be needed to aid insurance providers handle product danger

Insurance Retirement Annuities

Both concur that each state will need to reach its own verdict regarding whether their certain state warranty fund regulations enable CDA coverage. Until these regulatory concerns are settled, consumers might not be fully secured. As older Americans retire, they may face climbing healthcare prices, inflation, and the danger of outlasting their properties.

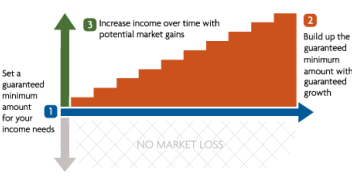

Lifetime revenue products can assist older Americans guarantee they have revenue throughout their retirement. VA/GLWBs and CDAs, two such products, might provide unique advantages to consumers. According to market participants, while annuities with GLWBs have actually been cost a variety of years, CDAs are fairly brand-new and are not commonly available.

GAO offered a draft of this record to NAIC and SEC (cash for annuities). Both supplied technological comments, which have actually been dealt with in the record, as suitable. For more info, contact Alicia Puente Cackley at (202) 512-8678 or

It ensures a fixed rates of interest each year, no matter of what the securities market or bond market does. Annuity warranties are backed by the monetary strength and claims-paying capability of American Cost savings Life Insurance Policy Firm. Security from market volatility Ensured minimum rates of interest Tax-deferred cash money buildup Capacity to stay clear of probate by assigning a beneficiary Option to turn part or every one of your annuity right into a revenue stream that you can never ever outlast (annuitization) Our MYGA uses the ideal of both worlds by ensuring you never ever shed a dime of your primary investment while at the same time assuring a rate of interest for the selected amount of time, and a 3.00% guaranteed minimal rate of interest for the life of the contract.

The rate of interest price is ensured for those abandonment charge years that you select. We have the ability to pay above-market interest rates because of our below-average expenses and sales expenditures as well as our regular above-average economic performance. 1-Year MYGA 5.00% 2-Year MYGA 5.25% 3-Year MYGA 5.25% 4-Year MYGA 5.25% 5-Year MYGA 5.25% 10% Yearly Penalty-Free Withdrawal Biker (no price) Penalty-Free Survivor benefit Rider (no price) Penalty-Free Persistent Ailment Biker (no expense) Penalty-Free Terminal Ailment Rider (no price) Penalty-Free Nursing Home Arrest Rider (no price) Multi-Year Guaranteed AnnuityAn Person Solitary Costs Fixed Deferred Annuity Rate Of Interest Options(Rate of interest differ by thenumber of years picked) 1-Year: 1-year surrender charge2-Years: 2-years surrender charge3-Years: 3-years give up charge4-Years: 4-years give up charge5-Years: 5-years abandonment cost Issue Ages 18-95 years of ages: 1 or 2 years durations18-90 years of ages: 3, 4, or 5 years periods Problem Age Decision Current Age/ Last Birthday Minimum Premium $25,000 Maximum Costs $500,000 per specific Price Lock Allocations For situations such as individual retirement account transfers and IRC Section 1035 exchanges, an allowance might be made to lock-in the application date rate of interest rateor pay a higher rates of interest that might be available at the time of issue.

Rates reliable as of November 1, 2024, and go through transform without notification. Withdrawals undergo regular revenue tax obligations, and if taken prior to age 59-1/2 may incur an added 10% federal fine. Early abandonments may lead to receipt of less than the initial premium. variable and fixed annuity. Neither American Cost Savings Life nor its producers give tax obligation or lawful advice.

Buy An Annuity

These payout rates, which consist of both interest and return principal. The rates stand for the annualized payout as percent of complete premium. The New York Life Clear Revenue Benefit Fixed AnnuityFP Series, a fixed delayed annuity with a Surefire Life Time Withdrawal Benefit (GLWB) Rider, is released by New York Life Insurance and Annuity Company (NYLIAC) (A Delaware Company), a wholly possessed subsidiary of New York Life Insurance Coverage Company, 51 Madison Opportunity, New York, NY 10010.

All assurances depend on the claims-paying capacity of NYLIAC. Products offered in accepted territories. There is a yearly rider charge of 0.95% of the Buildup Worth that is deducted quarterly - annuities options. * These figures are effective since date and undergo change at any kind of time. Based upon the life with cash reimbursement option, male annuitant with $100,000.

An ensured annuity price (GAR) is a promise by your pension provider to offer you a specific annuity rate when you retire.

Annuity Funds Definition

That can make a huge distinction to your retirement income. Certainly, that's not constantly the instance. If you have actually got health and wellness problems you may be qualified for an boosted annuity, which can likewise provide you a better price than you 'd typically get. And your ensured annuity could not include attributes that are necessary to you.

An assured annuity rate is the rate that you get when you buy an assured annuity from your company. This impacts just how much earnings you'll receive from your annuity when you retire. It's great to have actually an ensured annuity rate due to the fact that maybe much more than existing market prices.

Surefire annuity rates can go as high as 12%. That's approximately double the most effective prices you'll see on the market today. So (unless you receive an improved annuity) you can obtain two times the earnings you would certainly obtain from a non-guaranteed annuity rate annuity. You can shed your ensured annuity price if you alter to an additional kind of pension (definition of an annuity contract) or a different annuity carrier.

Are Annuities A Good Investment For Retirees

If you pick to move to a flexi-access pension plan, you might need to speak to a monetary adviser. If you don't currently have one, you can locate one at Honest. There might additionally be limitations on when you can establish up your annuity and take your guaranteed rate. As an example, you may have to buy it on your real birthday celebration, at a certain age or on your chosen retired life day.

It's an information that typically gets hidden in the fine print. fixed index annuity vanguard. Your provider may call it something like a 'retirement annuity agreement', or refer to a 'Area 226 policy', or simply speak about 'with-profits', 'benefits', 'advantageous' or 'assure' annuities. To locate out if you have actually got one, the best thing to do is to either ask your carrier straight or check with your financial advisor.

An annuity guarantee period is very different from an assured annuity or ensured annuity rate. This is a survivor benefit choice that switches your annuity repayments to a loved one (usually a partner) for a specific amount of time as much as 30 years - when you die. An annuity warranty duration will offer you peace of mind, however it likewise indicates that your annuity revenue will be a little smaller sized.

If you choose to transfer to one more carrier, you may lose your guaranteed annuity rate and the advantages that come with it. Yes - annuities can come with several different kinds of guarantee.

Single Pay Annuity

That can make things a little complicated. As you can envision, it's very easy to point out an ensured annuity or an assured annuity rate, suggesting a guaranteed earnings or annuity guarantee duration. Assured annuity prices are actually extremely different from them. So when people or companies begin speaking about annuity guarantees, it's vital to see to it you understand specifically what they're explaining.

Table of Contents

Latest Posts

Exploring Variable Vs Fixed Annuities Key Insights on Your Financial Future Defining the Right Financial Strategy Features of Smart Investment Choices Why Choosing the Right Financial Strategy Matters

Understanding Financial Strategies Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Features of Smart Investment Choices Why Fixed Income Annuity Vs Variable

Analyzing Fixed Vs Variable Annuity Pros And Cons A Comprehensive Guide to Investment Choices Breaking Down the Basics of Fixed Vs Variable Annuities Benefits of Variable Annuity Vs Fixed Indexed Annu

More

Latest Posts